Startup Registration India – 7 Steps to Register your Startup

A startup is a newly established business, usually small, started by 1 or a group of individuals. What differentiates it from other new businesses is that a startup offers a new product or service that is not being given elsewhere in the same way. The keyword is innovation. The business either develops a new product/ service or redevelops a current product/service into something better.

STARTUP INDIA

Startups are becoming very popular in India. In order to develop the Indian economy and attract talented entrepreneurs, the Government of India, under the leadership of PM Narendra Modi, has started and promoted the Startup India initiative to recognize and promote startups.

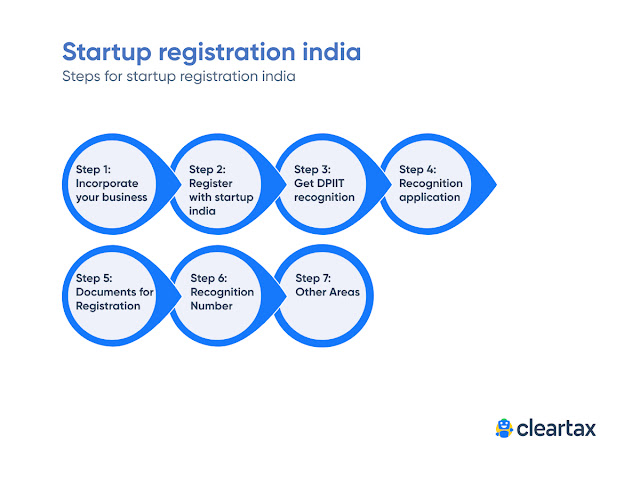

STEPS TO REGISTER YOUR STARTUP WITH STARTUP INDIA

STEP 1: INCORPORATE YOUR BUSINESS

You must first incorporate your business as a Private Limited Companyor a Partnership firm or a Limited Liability Partnership. You have to follow all the normal procedures for registration of any business like obtaining the Certificate of Incorporation/Partnership registration, PAN, and other required compliances.

STEP 2: REGISTER WITH STARTUP INDIA

Then the business must be registered as a startup. The entire process is simple and online. All you need to do is log on to the Startup India website and fill-up the form with details of your business. Next, enter the OTP which is sent to your e-mail and other details like, startup as the type of user, name and stage of the startup, etc. After entering these details, the Startup India profile is created.

Once, your profile is created on the website, startups can apply for various acceleration, incubator/mentorship programmes and other challenges on the website along with getting access to resources like Learning and Development Program, Government Schemes, State Polices for Startups and pro-bono services.

STEP 3: GET DPIIT RECOGNITION

The next step after creating the profile on the Startup India Website is to avail Department for Promotion of Industry and Internal Trade (DPIIT) Recognition. This recognition helps the startups to avail benefits like access to high-quality intellectual property services and resources, relaxation in public procurement norms, self-certification under labour and environment laws, easy winding of company, access to Fund of Funds, tax exemption for 3 consecutive years and tax exemption on investment above fair market value.

For getting DPIIT Recognition, click on the ‘Get Recognised’ button if you are a new user. If you are an existing user click on the ‘Dashboard button’ and then ‘DPIIT Recognition’.

STEP 4: RECOGNITION APPLICATION

The ‘Recognition Application Detail’ page opens. On this page click on ‘View Details’ under the Registration Details section. Fill up the ‘Startup Recognition Form’ and click on ‘Submit’.

STEP 5: DOCUMENTS FOR REGISTRATION

- Incorporation/Registration Certificate of your startup

- Details of the Directors

- Proof of concept like pitch deck/website link/video (in case of a validation/ early traction/scaling stage startup)

- Patent and trademark details (Optional)

- PAN Number

STEP 6 : RECOGNITION NUMBER

That’s it! On applying you will immediately get a recognition number for your startup. The certificate of recognition will be issued after the examination of all your documents which is usually done in 2 days after submitting the details online.

However, be careful while uploading the documents. If on subsequent verification, it is found to be obtained that the required document is not uploaded/wrong document uploaded or a forged document has been uploaded then you shall be liable to a fine of 50% of your paid-up capital of the startup with a minimum fine of Rs. 25,000.

STEP 7: OTHER AREAS

Patents, trademarks and/or design registration: If you need a patent for your innovation or a trademark for your business, you can easily approach any from the list of facilitators issued by the government. You will need to bear only the statutory fees thus getting an 80% reduction in fees.

Funding: One of the key challenges faced by many startups has been accessing finance. Due to lack of experience, security or existing cash flows, entrepreneurs fail to attract investors. Besides, the high-risk nature of startups, as a significant percentage fail to take off, puts off many investors.

In order to provide funding support, the Government has set up a fund with an initial corpus of INR 2,500 crore and a total corpus of INR 10,000 crore over a period of 4 years (i.e. INR 2,500 crore per year). The Fund is in the nature of Fund of Funds, which means that it will not invest directly into Startups, but shall participate in the capital of SEBI registered Venture Funds.

Self Certification Under Employment and Labour Laws: Startups can self certify under labour laws and environment laws so that their compliance costs are reduced. Self-certification is provided to reduce regulatory burden thereby allowing them to focus on their core business. Startups are allowed to self-certify their compliances under six labour laws and three environment laws for a period of 3 to 5 years from the date of incorporation.

Units operating under 36 white category industries as published on the website of the Central Pollution Control Board do not require clearance under 3 environment-related Acts for 3 years.

Tax Exemption: Startups are exempted from income tax for 3 years. But to avail these benefits, they must be certified by the Inter-Ministerial Board (IMB). The Startups incorporated on or after 1st April 2016 can apply for the income tax exemption.

DOCUMENTS WHICH HAVE BEEN WAIVED OFF

Startup India has changed the procedure of registration since its inception. It has exempted most of the previous requirements now. Many documents which were required to be filed previously are waived off. The list of documents that are not required to be filed at the time of the registration are-

- Letter of Recommendations

- Letter of funding

- Sanction Letters

- Udyog Aadhar

- MSME Certificate

- GST Certificate

KEY FEATURES OF THE FUND OF FUNDS

- The Fund of Funds shall be managed by the Small Industries Development Bank of India (SIDBI)

- Life Insurance Corporation (LIC) shall be a co-investor in the Fund of Funds

- The Fund of Funds shall contribute to a maximum of 50% of the SEBI registered Venture Funds (“daughter funds”). In order to be able to receive the contribution, the daughter fund should have already raised the balance 50%. The Fund of Funds shall have representatives on the board of the venture fund based on the contribution made.

- The Fund shall ensure support to a broad mix of sectors such as manufacturing, agriculture, health, education, etc.

It’s very easy to register as a startup thanks to the various government initiatives. However, you can focus on your key area while we at ClearTax help you from start to finish right from incorporating your company to getting your startup recognition. Do visit our website to know more about startup services.

FREQUENTLY ASKED QUESTIONS ON STARTUP REGISTRATION INDIA

Who can register with startup India?

An entity incorporated as a Private Limited Company, Partnership Firm or a Limited Liability Partnership can register themselves under the startup India scheme. The annual turnover of these business entities should not exceed 100 crores, and they should have been in existence for up to ten years from the date of its incorporation/ registration. Such an entity should be working towards innovation, development or improvement of products or services or processes.

What are the benefits of signing up with startup India?

There are a number of benefits startups receive by the Startup India Scheme. Nevertheless, in order to avail these benefits, an entity is needed to be set up by the DPIIT as a startup.

Startups are allowed to self certify their compliance with six labour laws and three environment laws. This is allowed for a total period of five years from the date of incorporation/registration of the entity. Startups are allowed a three-year tax exemption and the best intellectual property services and resources solely built to help startups protect and commercialise their IPRs.

WHAT KIND OF BUSINESS STRUCTURE SHOULD I CHOOSE FOR MY STARTUP?

The most preferred business structures for a startup are Private Limited companies and LLPs. A Private Limited company is legally recognized and generally favoured by investors. However, it has stricter compliance and may have a higher cost of incorporation.

Whereas incorporation cost is lower for LLPs and they tend to have relaxed compliance in comparison to Pvt. Ltd. Co. In addition to that, LLPs have limited liabilities and are equally recognised by investors and all over the world.

What can I do to attract investors to a start-up?

To attract investors, not only do you need a stellar product with a scalable model, but you also need visibility. Make sure that your product receives healthy engagement and traction. You’ll need to register your startup on startup India and proactively seek out investors. Make sure you are able to effectively communicate your business idea to the investor and the sustainability of your business model.

Can a foreign company register under the Startup India hub?

Any entity that has at least one registered office in India can register itself on the hub, since the location preferences, for the time being, are only created for Indian states. However, soon the government hopes to start registrations for stakeholders from the global ecosystem too.

What is the difference between an accelerator and an incubator?

Startup incubators are typically institutions that help entrepreneurs by developing their business, especially in the initial stages. The incubation function is usually carried out by institutions that have experience in the business and the tech world.

Startup accelerators support early-stage, growth-driven companies. These programmes usually have a timeframe in which individual companies spend anywhere between a few weeks and a few months working with a group of mentors who are educated and may also provide financial help.

For how long is a company recognised as a startup?

Any business entity that has completed 10 years from the date of its incorporation/registration, and has exceeded the previous years turnover of 100 crores shall stop to be a startup on completion of 10 years from the date of its registration/incorporation.

Can an existing entity register itself as a “Startup” on the Startup India Portal?

Yes, as per the law an existing entity can register itself as a startup, provided that it meets the prescribed criteria for a startup. They will also be able to avail various tax and IPR benefits that are available to startups. The criteria are the same as those mentioned in the article above.

How do I know my registration is complete?

Once the application is complete, and the startup gets recognised, you will receive a system-generated certificate of recognition. You will be able to download this certificate from the Startup India portal.

------------------------------------------------------------------------